arizona solar tax credit 2019

Every resident in Arizona who installs solar panels gets a State Tax Credit of 25 of the total system cost up to 1000 to be used toward State income taxes. Posted on July 23 2019 August 17 2021 by admin.

Salt River Tubing Fun In The Sun Salt River Tubing Tubing River Fun

The federal residential solar energy credit is a tax credit that can be.

. Note that because reducing state. See Ratings Compare. Individual tax credit for an individual who installs a solar energy device in taxpayers residence located in Arizona.

Arizona solar tax credit. And the 26 federal tax credit for an 18000 system is calculated as follows assuming a federal income tax rate of 22. Ad Find The Best Solar Providers In Arizona.

This incentive is an Arizona personal tax credit. Was the federal solar tax credit extended. Arizonas Solar Energy Credit is available to individual taxpayers who install a solar or wind energy device at the taxpayers Arizona residence.

Arizona Residential Solar Energy Tax Credit Buy new solar panels in Arizona and get a 25 credit of its total cost against your personal income taxes owed in that year. The credit is allowed against the. Ad Find The Best Solar Providers In Arizona.

Arizona Residential Solar and Wind Energy Systems Tax Credit. This tax credit is good through 2022. 23 rows Did you install solar panels on your house.

Individuals in Arizona receive a tax credit for 25 of. See Ratings Compare. Arizona solar tax credit 2019 Monday March 21 2022 Edit.

Favorable laws rebates property and sales tax. Yes the solar investment tax credit. Although the Federal Investment Tax Credit also known as the ITC was extended at the end of 2020 it will continue to decline and will be completely eliminated by the year 2024 for.

June 6 2019 1029 AM. The Federal Investment Tax Credit ITC is available to Arizona homeowners who purchase their solar panel system. Arizona Personal Tax Credit.

Renewable Energy Production Tax Credit. For people interested in saving money and diminishing their carbon footprint installing solar panels are now a much more affordable and realistic option. The Consolidated Appropriations Act of 2021 bill extended the 26 investment tax credit through 2022.

It is valid the year of. Enter Your Zip Find Out How Much You Might Save. The Residential Arizona Solar Tax Credit reimburses you 25 percent of the cost of your solar panels up to 1000 right off of your personal income tax in the year you install the system.

So for every 1 you spend on your solar power system you. 026 1 022 025 455. Arizona solar tax credit.

This is claimed on Arizona Form 310 Credit for Solar Energy Devices. It was originally going to drop to 22 in. The state sales tax of 56 does not apply to solar.

Arizonans Dont Forget the Federal Solar Tax Credit. Ad Free Arizona Solar Quotes. Your Name as shown on Form 140 140PY or 140X Your Social Security Number Spouses Name as shown on Form 140 140PY or 140X if a joint return Spouses Social Security Number Part.

Enter Your Zip Find Out How Much You Might Save. Arizona Department of Revenue tax credit. The credit amount allowed against the taxpayers personal income tax is.

25 of the gross system cost up to a maximum of 1000. See details about the federal personal tax credit here. Arizona is a leading state in the national solar power and renewable energy initiative.

The tax credit remains at 30 percent. Which Arizona tax form is used for solar energy tax credits. In 2019 the maximum credit allowed for single.

The Arizona Solar Tax Credit lets you deduct up to 1000 from your personal Arizona income taxes. Arizona Renewable and Solar Energy Incentives. This tax credit also known as the Investment Tax Credit or ITC is a dollar-for-dollar reduction in the federal income tax you owe.

Here are the specifics. An individual or corporate income tax credit is available for taxpayers who own a qualified energy generator that first produces electricity before Jan.

Solar Industry Employment Rebounds In 2019 Solar Tribune

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

2019 Pennsylvania Home Solar Incentives Rebates And Tax Credits Tax Credits Incentive Pennsylvania

2013 And 2016 Energy Code Infographic Energyefficient Energyefficiency Caenergy Energy Efficiency 30 Year Mortgage Energy

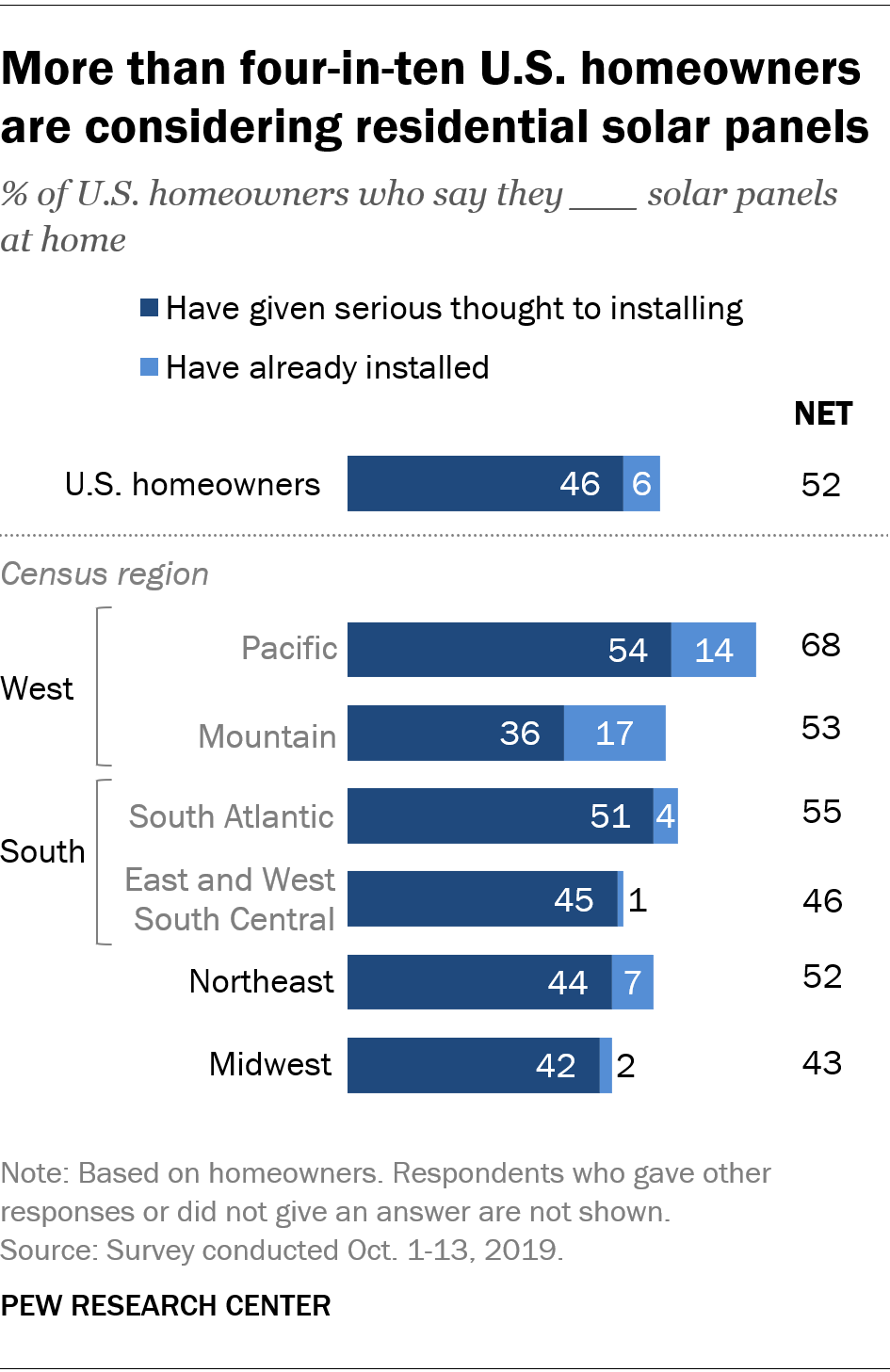

More U S Homeowners Say They Are Considering Home Solar Panels Pew Research Center

Shining Cities 2020 Environment California

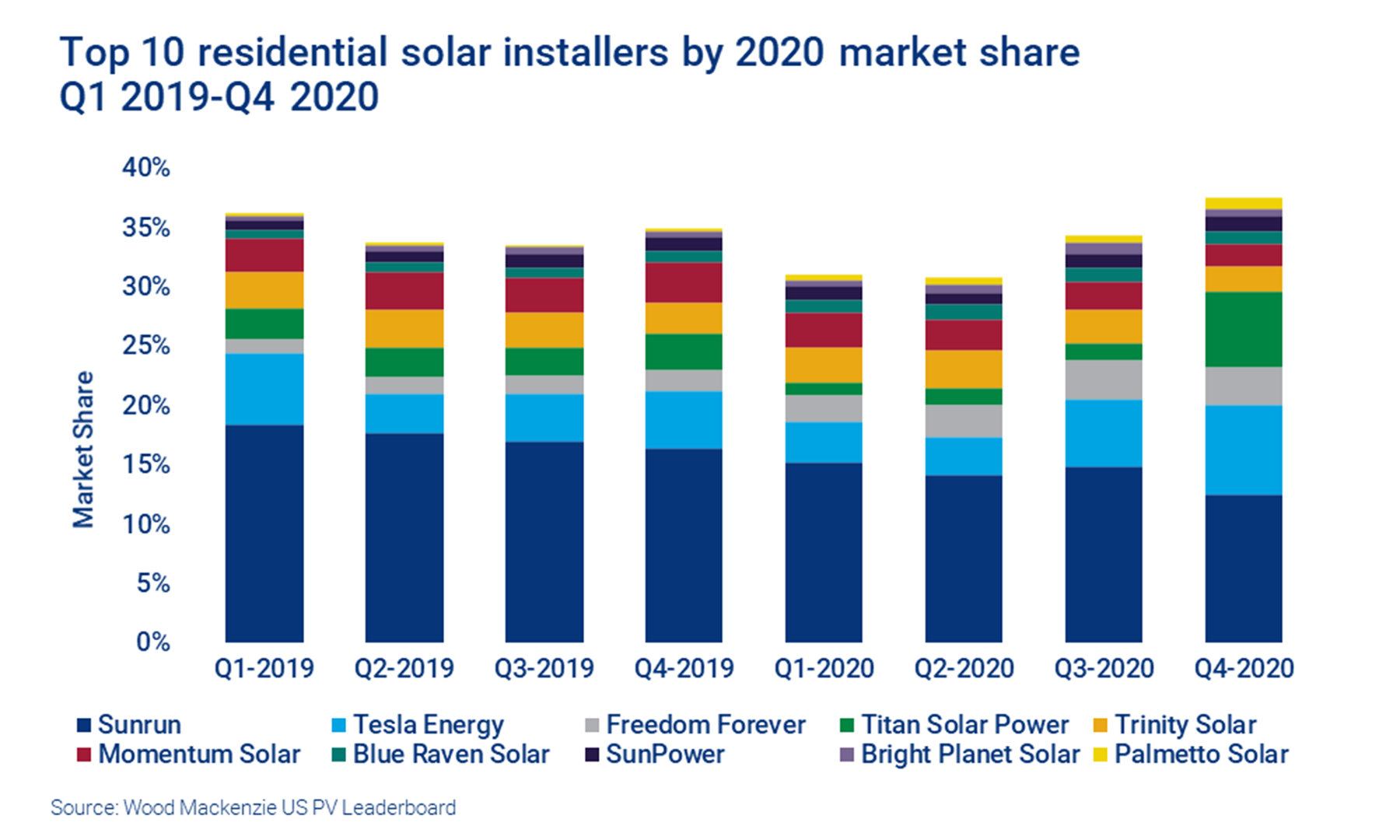

Sunrun Retains Its Title As Largest Residential Solar Installer In The Us Wood Mackenzie

The Ultimate 2020 Guide To California Solar Tax Credit And Incentives

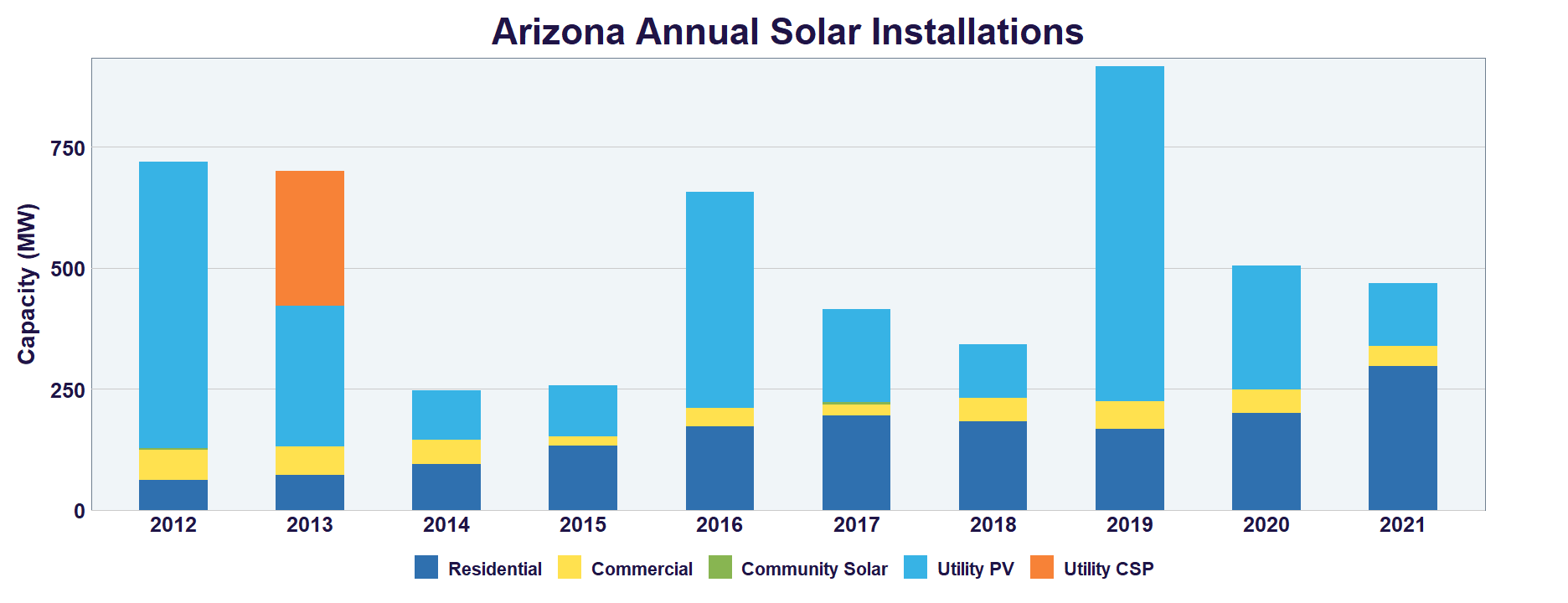

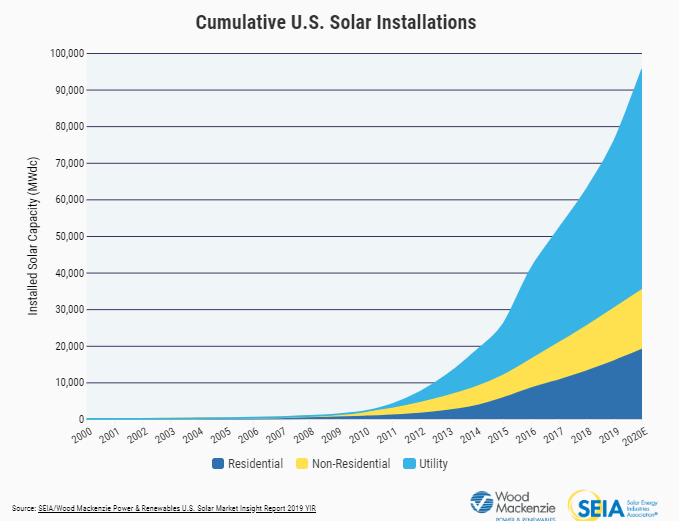

2019 Was A Record Year For U S Solar Power Wells Solar

The State Of Solar 350 Brooklyn

Guide To Federal Solar Investment Tax Credit Rooftop Solar

Solar Tax Credit In 2021 Southface Solar Electric Az

2019 Was A Record Year For U S Solar Power Wells Solar

How To Calculate The Federal Solar Investment Tax Credit Duke Energy Sustainable Solutions

Federal Solar Tax Credit For Homeowners Complete Guide Energysage

Solar Power Statistics In The Usa 2019 Sf Magazine

Southeast Us Adds 427 Mw Of Distributed Solar In 2019 As Advocates Press For More Pv Magazine Usa Energy Plan Solar News Solar Program